Case Study

Business Modeling Platform

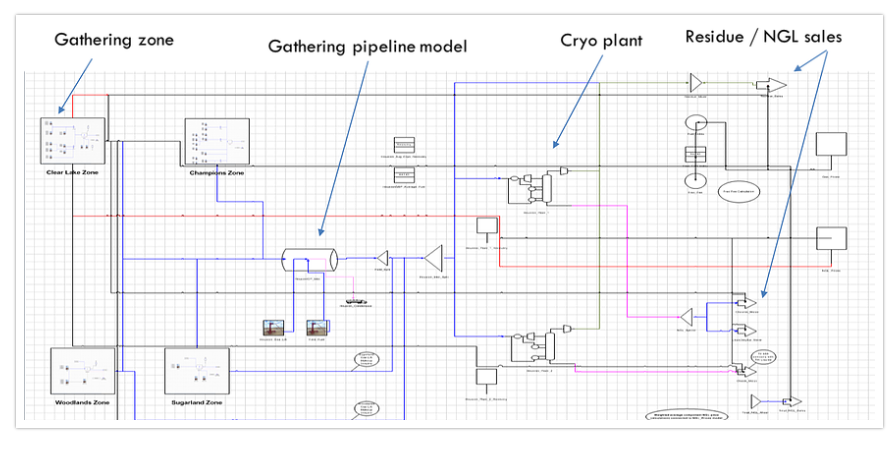

The eSimEvaluator business model considers both physical and commercial interactions from wellhead to sales points and provides a common, model-based, decision platform with which to manage the company’s business. The eSimEvaluator business modeling platform consists of the components below.

Production Forecast Module

Makes it easy to track declining production volumes, and growth volumes, for each area and load them into the eSimEvaluator business model.

Flowsheet Visualization

Where all flows are defined from wellhead through gathering, compression, processing, and residue / NGL sales points. Similarly, all economic interactions are graphically constructed and maintained.

- Build initial asset model – Drag model onto flowsheet and connect physical and economic interactions

- Troubleshoot physical / commercial aspects of model

- Modify model structure

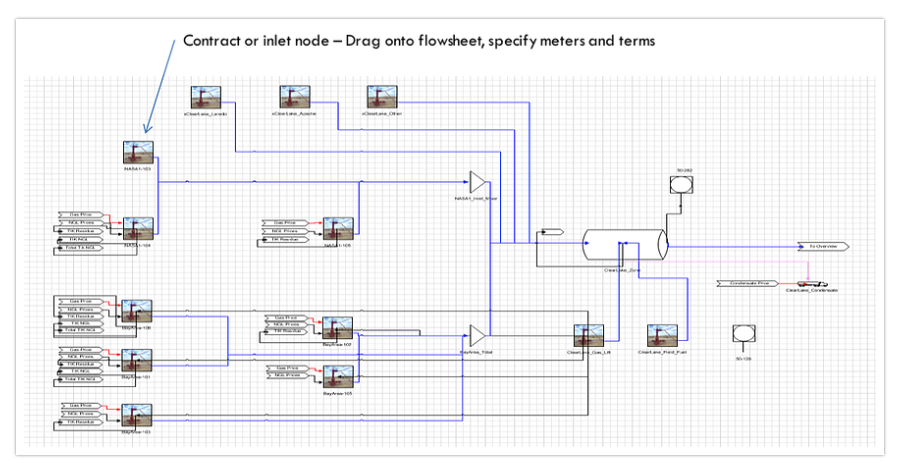

Drill Down

Drill Down to gathering zone and inlet node configuration

High performance, Open-equation Based Optimization Engine

Which allows large supersystem models, and multi-supersystem enterprise models, to be solved quickly and robustly. The eSimEvaluator solution solves a complete mole balance across the system. This reduces the possibilities of “fat fingering” or hard coding a value and having a spreadsheet solve to a totally incorrect value. With eSimEvaluator the material balance must solve and anomalies are much easier to catch before they effect business decisions. The flowsheet visualization environment helps keep connections and interactions modeled properly. The solver engine provides a second checkpoint. Result: much more confident business decision processes.

Case Group

Provides what-if case studies, sensitivity analyses, and long term forecasts to be specified that consider producer contract terms, assumed compositions for inlet gas, plant capacities compression capacities, planned equipment and plant capacity additions, assumed plant recovery including maintenance turnarounds, and residue / NGL contract dynamics. The eSimEvaluator model is then run sequentially to develop a gross margin forecast that reflects case group assumptions. Changes to the assumptions are quick and easy (i.e. high price deck assumptions, low pricing assumptions, and best guess pricing for budget analyses).

SQL Case Storage/Retrieval

Where case input data, commercial constraints, process constraints, and assumptions are kept along with case run results which can be referenced at any time for lookback analyses.

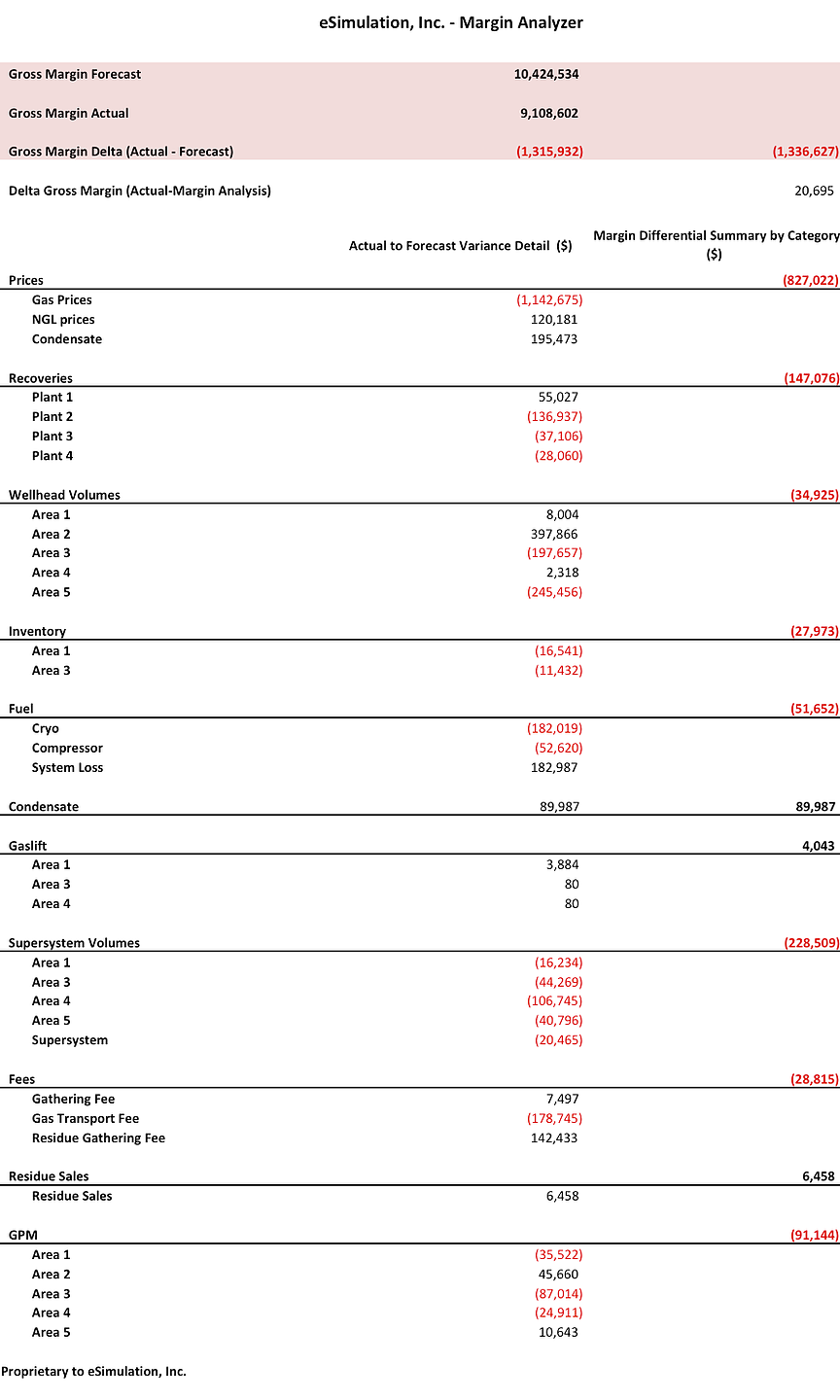

Margin Analyzer

Allows the user to compare any two cases, identify precisely what changed between the cases (to the inlet meter), and calculates the gross margin impact for each of the changes to easily run variance and case analyses. The Margin Analyzer immediately answers the challenging midstream question “what changed, and what is the effect of each of the changes on gross margin?” Example of detailed rollup that is developed in minutes is as follows:

Corporate Rollup Module

Combines individual asset models into a master model to run macro level analyses.

- On an individual supersystem basis, gathering and processing asset models are combined into a supersystem model, connections between each asset defined, macro-level cases are run (i.e. price and volume assumptions), and the overall operational plan for the supersystem is developed. The individual models can be extracted at any time, updated, and recombined into the supersystem model. This dramatically improves the maintainability of the supersystem model.

- Likewise, multiple supersystem models can be combined and configured with interconnects and constraints (i.e. volume commitments to Mt Belvue, residue pipeline commitments, etc.) The eSimEvaluator business model will develop an optimal solution for how to meet those commitments in the most profitable manner.

The eSimEvaluator business model provides a common decision platform for commercial, operations, marketing, planning, and engineering to manage and optimize the business in a coordinated fashion. The models can be built and maintained by clients on their own or/and with eSimulation’s assistance. The eSimEvaluator business model allows clients to manage all aspects of the business including:

- What-if scenarios to explore ways of improving profitability and to consider running detailed justification studies to analyze build-out scenarios for the assets

- Gathering movements to get the best gas to the plants and to run a highly detailed analysis to determine which mode (rejection or recovery) each cryo train should be run in

- Best disturbance response given multiple market optionality, T&F provisions, volume commitments / penalty structures, hydraulic constraints (from separate hydraulic model)

- Develop monthly and rolling forecasts for residue, NGL, and condensate to support marketing, nominations, and hedging decisions

- Run the annual budget under a variety of pricing and volume assumptions.

- Run detailed variance analyses in minutes.

"*" indicates required fields